How Have We Performed?

Terra Flow-Through LP’s have performed well and provided attractive after-tax returns.

The Terra Difference

Terra LPs vs its peers. Easily distinguishable.

| - | - | - |

|---|---|---|

| Per $1,000 Investment | TERRA LPs | PEER GROUP |

| Offering Type | OM | Prospectus |

| Flow-through share type | Mining | Mining |

| Investments | 100% public companies | ≥ 80% public companies |

| Diversification | Yes ~ 25 or more investments | Yes ~ varies |

| CEE tax deductions | $1,053 ~$1,088 | $880 ~ $1,050 |

| 30% Critical Mineral Exploration Tax Credit | Up to $270 | Up to $270 |

| 15% Mineral Exploration Tax Credit | Up to $135 | Up to $135 |

| Provincial Mineral Tax Credit | TBD for BC, SK, MB, ON | Various |

| Provincial Mineral Tax Deduction | TBD for QC | Various |

| Rollover / Maturity (target date) | June 2026 | Sept 2026 ~ July 2027 |

| FL: A Class | Yes | Yes |

| NL: F Class | Yes | Yes |

| Minimum investment | $5,000 | Varies |

| Management Fee | 2% | 2% |

| Performance Bonus | 20% | 20% ~ 30% |

| Auditors | RSM LLP | Various |

| Legal & Tax | Stikeman Elliott LLP | Various |

| Custodian | Canadian Western Trust Company | Various |

| Availability | Canada-wide | Canada-wide |

Investors should refer to the Offering Memorandum for more detailed information. The figures are for illustrative purposes only and are not intended as a forecast of future events. Actual tax deductions may be more or less. Tax rates are subject to change.

How We Build Portfolios

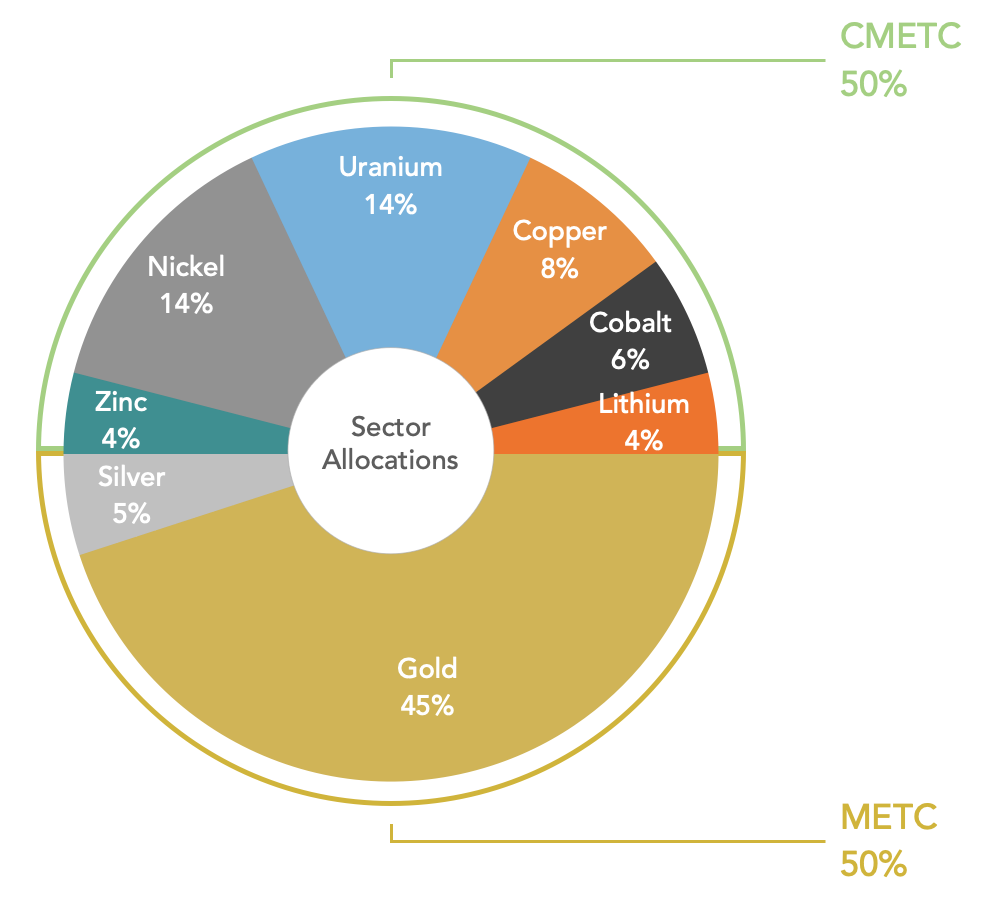

Terra actively invests and manages a diversified portfolio of Flow-Through shares of publicly listed mining firms exploring for critical minerals (cobalt, copper, lithium, nickel, uranium, zinc, etc.) or precious minerals (gold, sliver, etc.), which provide attractive tax savings and potential additional returns.

Mining Super Flow-Through Shares

Targeted allocations are 50% to flow-through shares providing the 30% critical mineral exploration tax credit (CMETC) & 50% to flow-through shares offering the 15% mineral exploration tax credit (METC).

Sector weightings are determined through individual stock selection by the portfolio manager. With investment, your capital is at risk.

Mining Investments

Terra LPs invest in public mining firms, which provide: (1) Canadian exploration expenses (CEE); (2) either the 15% mineral exploration tax credit (METC) or the new 30% critical mineral exploration tax credit (CMETC); and (3) additional provincial tax credits for investors resident in BC, SK, MB or ON. Terra LPs provide up to 130% in tax deductions and tax credits.